Investing in the stock market is a lot like shopping for winter coats in the middle of summer. When the sun is blazing and temperatures are soaring, nobody is thinking about buying a thick parka. Retailers, desperate to clear their inventory, slash prices. But when winter finally arrives, those same coats fly off the shelves at double or triple the price.

And if you’re asking yourself, “Should I buy stocks now?”…

You’re onto something that could take your wealth to the next level. Because the same principle applies to investing: The best time to buy stocks is when they’re out of favor, when fear is in the air, and when everyone else is running for the exits.

That’s right. The worst days in the market often turn into the best opportunities. And if history has taught us anything, it’s that investors who keep a cool head while others are losing theirs often walk away with incredible profits.

So today let’s take a look at four famous times when bold investors went against the grain, bought stocks when everyone else was selling, and laughed all the way to the bank…

Should I Buy Stocks Now? Warren Buffett Says Yes

Market Situation: The financial crisis of 2008 wiped out trillions of dollars in market value. Banks were collapsing, Lehman Brothers had gone under, and the phrase “too big to fail” was becoming painfully ironic. The S&P 500 had cratered by more than 50%, and fear was at an all-time high.

What Happened: While most investors were running for the hills, Warren Buffett saw opportunity. He poured billions into struggling financial institutions like Bank of America and Goldman Sachs. His deal with Goldman, for example, involved preferred shares that paid him a 10% dividend — an incredibly lucrative arrangement.

The Payoff: By 2013, the market had rebounded and Buffett’s bank bets had yielded massive gains. His investment in Bank of America alone, which included a sweet deal on warrants, eventually turned into tens of billions in profits.

Buffett turned his $5 billion bet into well over $30 billion.

Lesson: When everyone else thinks the world is ending, that's often the best time to go shopping. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”The Best Free Investment You’ll Ever Make

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

Should I Buy Stocks Now? John Templeton Wouldn’t Let a World War Stop Him

Market Situation: In 1939, World War II had just begun. The world was in chaos, uncertainty reigned, and the U.S. stock market had been battered by years of the Great Depression. Most investors wanted nothing to do with stocks.

What Happened: John Templeton saw the fear and decided to take action. He borrowed $10,000 (a significant sum at the time) and bought 100 shares in every public company trading for $1 or less — many of them struggling war-related businesses.

The Payoff: By the time the war ended, the stock market had staged a massive recovery and Templeton’s portfolio had soared. His strategy of buying when others were fearful laid the foundation for his legendary investing career.

Lesson: The best opportunities often come when people are convinced things will never get better.

Should I Buy Stocks Now? Even in a “Lost Decade”

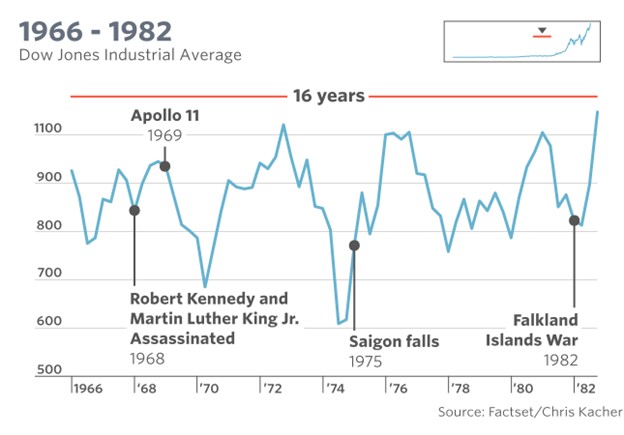

Market Situation: The 1970s were brutal for investors. The U.S. economy was hammered by a toxic mix of high inflation, slow economic growth (stagflation), and an energy crisis that sent oil prices soaring. The Dow Jones Industrial Average, which had peaked near 1,000 in the late 1960s, drifted down for nearly a decade, bottoming out around 600 in the mid-1970s. Many believed the stock market would never recover.

What Happened: While most investors were disillusioned, legendary names like Warren Buffett and Peter Lynch saw massive opportunities. Buffett bought shares of undervalued companies like The Washington Post at dirt-cheap prices, while Peter Lynch began his career by investing in beaten-down stocks that had strong fundamentals.

The Payoff: The 1980s and 1990s turned into one of the greatest bull markets in history. Stocks purchased at rock-bottom prices during the stagflation era turned into tenfold or even hundredfold gains in the decades that followed. In fact, Lynch's investors saw gains worth over 2,700% by the start of the 1990s…

Lesson: Even when the economy seems broken beyond repair, markets have a way of bouncing back stronger than ever.

Should I Buy Stocks Now? Buying Busted Bubbles

Market Situation: In the late '90s, tech stocks were all the rage — until they weren’t. The Nasdaq plunged nearly 80% from its peak in 2000 to its bottom in 2002. Companies that were once Wall Street darlings became the subject of jokes.

What Happened: While many investors swore off tech forever, smart money saw an opportunity. Savvy investors like Jeff Bezos (Amazon’s founder) and Peter Thiel (who backed PayPal and Facebook) used the downturn to double down on promising tech stocks at dirt-cheap prices.

The Payoff: Investors who bought companies like Amazon, Apple, and Google at their lows saw life-changing returns over the next two decades.

Lesson: The best companies don’t cease to exist just because their stock prices take a temporary beating.

The Bottom Line: Be Bold When Others Are Fearful

The stock market has a long history of rewarding those who buy when fear is highest. While most people panic and sell, the investors who stay calm, do their research, and invest in great companies at discount prices end up with the biggest gains and become legends in the markets.

So the next time the market is plunging, remember: This is when the real money is made.

And if you’re ready to stop following the crowd and start thinking like a true investor, join a community of like-minded individuals who believe in being bold when others are afraid.

It’s time to invest with confidence — are you in?

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube